The Get Legit Toolkit® course has helped over 2500 makers & biz owners since 2017.

This self-paced, on-demand course developed by a CPA, maker, and ecomm seller covers the seven financial cornerstones of running a business:

1️⃣ Banking

|

2️⃣ Bookkeeping

|

3️⃣ State Sales Tax

|

4️⃣ State & Local Licenses

|

5️⃣ Federal Income Tax

|

6️⃣ Saving for Taxes

|

7️⃣ Inventory

|

When you’ve completed the Get Legit Toolkit®, you’ll finally figure out:

- Exactly what you need to do to from a financial perspective to set your business up right

- How to organize your business funds, bookkeeping system, and financial documentation sensibly

- What you're required to do on a state & local level and exactly how sales tax works

- What to expect at tax time and how to prepare throughout the year to avoid any stressful surprises

- The accounting concepts you need to truly comprehend as a successful business owner (and nothing extra!)

- How to feel confident about the money side of your biz and breathe easy in the knowledge that you aren't missing something important

Stop spinning your wheels and get your tax & financial questions answered in plain English!

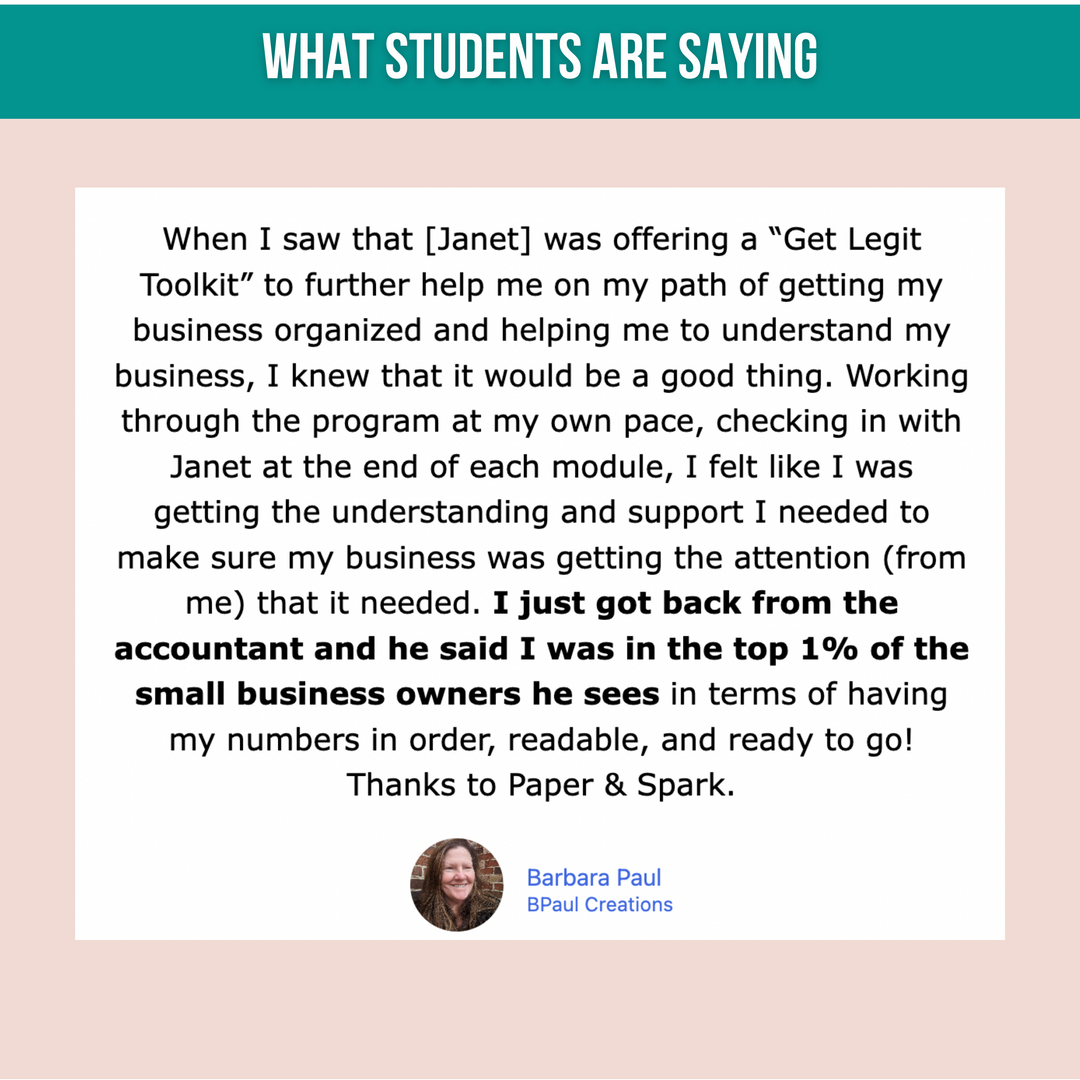

Get the accountability & support you need.

Your Toolkit includes access to our private Facebook group. Ask questions as you work through the course content. Stay motivated with community and peer support.

Work on your own schedule.

You can complete this course from your couch or your home office - anywhere you have access to WiFi.

The Get Legit Toolkit consists of a healthy mix of videos, text, and PDF worksheets. You can access the content from anywhere and work at your own pace. There's also a private audio podcast version of the course so you can listen & learn on the go.

I recommend you set aside about 3-6 hours a week for 3-4 weeks to work through the course.

Plus, you get lifetime access - so you can always refresh yourself on a particular topic when needed.

FAQs about the Get Legit Toolkit®

No. I have a few Etsy-centric tutorials, but the concepts in the Toolkit are universally applicable no matter where you sell. Any sort of handmade shop owners, e-commerce sellers, or even brick & mortar retailers are welcome!

The course includes access to the private Get Legit Community on Facebook. This is the place where you can ask questions about the course material as you work!

No. I review a few bookkeeping options in this program, including Paper + Spark spreadsheets, but none are included. The program is not specific to whatever bookkeeping system you decide to use.

Yes - I keep the course updated as rules related to small business taxes evolve. Since debuting it in 2017, there have been changes with income taxes & the Qualified Business Income deduction, online sales taxes, and more. The Toolkit is and will continue to be your one-stop resource to learn about all financial aspects of running your shop.

The Toolkit is meant to be worked through at your own pace. You will complete some really important foundational steps for your business - like getting your sales tax permit, setting up sales tax in your online shop, and opening a business bank account. Some of these action steps will take time, and others can be done quickly & painlessly online. For most people, the course should take 3-4 weeks to complete, spending about 3-6 hours a week working on it.

I strongly recommend you only enroll in this course if you're based in the US. Although there is some universally applicable content, many of the lessons focus on US tax rules.